We are happy to share some insights about Sigma Computing drawn from our latest market research, Ventana Research Buyers Guide: Analytics and Data, which assesses how well vendors’ offerings meet buyers’ requirements.

We recently published five Ventana Research 2023 Analytics and Data Buyers Guides, an assessment of technology vendors and products that provide individual and combined  analytics and data, augmented analytics, collaborative analytics, embedded analytics and mobile analytics and platform support.

analytics and data, augmented analytics, collaborative analytics, embedded analytics and mobile analytics and platform support.

At Ventana Research, we continue to believe that, for most use-cases, there is a clear choice for analytics and data platforms for any use in your organization. We developed five technology assessments and buyers guides to focus on overall analytics and data requirements as well as specific augmented analytics, collaborative analytics, mobile analytics and embedded analytics use-cases.

In all of our Buyers Guides, we utilize a structured research methodology called the Value Index that includes evaluation categories designed to reflect real-world criteria incorporated in a request for proposal (RFP) and vendor selection process for analytics and data. We evaluated Sigma Computing and 21 other vendors in seven categories, five relevant to the product (adaptability, capability, manageability, reliability and usability) and two related to the vendor (TCO/ROI and vendor validation). To arrive at the Value Index rating for a given vendor, we weighted each category to reflect its relative importance in an RFP process, with the weightings based on our experience and on data derived from our benchmark research on analytics and data.

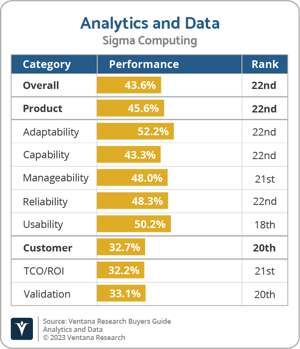

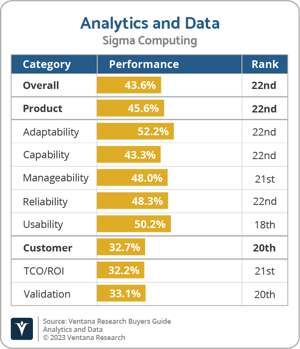

In the overall Analytics and Data Buyers Guide, our analysis classified Sigma Computing as a vendor of Merit, ranking 22nd in the overall research at 43.6%. Sigma Computing’s best performance came in Customer Experience at 32.7%, ranking 20th, due in part to its 20th-place ranking in Validation. In Product Experience, Sigma Computing placed 22nd at 45.6% due to low performance in Reliability, Adaptability and Capability. Sigma Computing did not participate in the RFI process.

performance came in Customer Experience at 32.7%, ranking 20th, due in part to its 20th-place ranking in Validation. In Product Experience, Sigma Computing placed 22nd at 45.6% due to low performance in Reliability, Adaptability and Capability. Sigma Computing did not participate in the RFI process.

Sigma Computing’s Product Experience was impacted by its 43.3% performance in Capability, where it could provide more predictive and notification functionality. Customer Experience was impacted by its 32.2% performance in TCO/ROI, where it could provide more information the help an organization quantify costs and benefits.

Sigma Computing performed best in Product Experience, notably in Usability, where its 50.2% performance was due to its support for data entry, which few vendors offer, and rapid training based on its spreadsheet-style interface. In addition, Sigma Computing’s collaborative functionality, both within the product and in third-party products, boosted its performance in Capability.

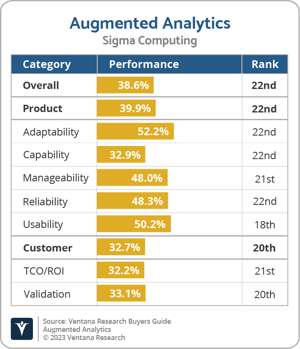

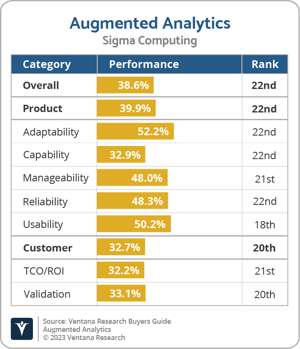

In the Augmented Analytics Buyers Guide, our analysis classified Sigma Computing as a vendor of Merit, ranking 22nd in the overall research at 43.6%. Sigma Computing’s best performance came in Customer Experience at 32.7%, ranking 20th, due in part to its 20th-place ranking in Validation. In Product Experience, Sigma Computing placed 22nd at 39.9% due to low performance in Reliability, Adaptability and Capability. Sigma Computing did not participate in the RFI process.

performance came in Customer Experience at 32.7%, ranking 20th, due in part to its 20th-place ranking in Validation. In Product Experience, Sigma Computing placed 22nd at 39.9% due to low performance in Reliability, Adaptability and Capability. Sigma Computing did not participate in the RFI process.

Sigma Computing’s Product Experience was impacted by its 32.9% performance in Capability, where it lacks NLP and predictive modeling functionality. It also lacks automated agents and alerting. Customer Experience was impacted by its 32.2% performance in TCO/ROI, where it could provide more information the help an organization quantify costs and benefits.

Sigma Computing performed best in Product Experience, notably in Usability, where its 50.2% performance was due to its support for data entry, which few vendors offer, and rapid training based on its spreadsheet-style interface. In addition, Sigma Computing provides built-in forecasting functionality based in part on its data entry capabilities.

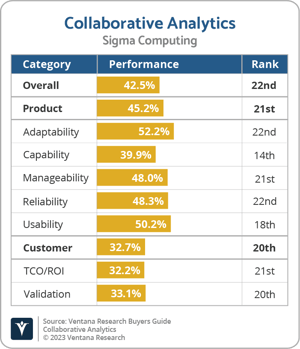

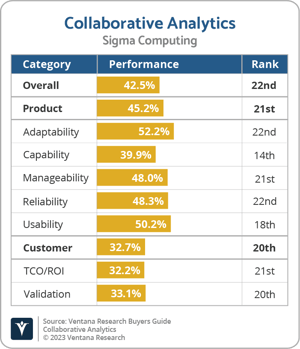

In the Collaborative Analytics Buyers Guide, our analysis classified Sigma Computing as a vendor of Merit, ranking 22nd in the overall research at 42.5%. Sigma Computing’s best performance came in Customer Experience at 32.7%, ranking 20th, due in part to its 20th-place ranking in Validation. In Product Experience, Sigma Computing placed 21st at 45.2% due to low performance in Reliability and Adaptability. Sigma Computing did not participate in the RFI process.

performance came in Customer Experience at 32.7%, ranking 20th, due in part to its 20th-place ranking in Validation. In Product Experience, Sigma Computing placed 21st at 45.2% due to low performance in Reliability and Adaptability. Sigma Computing did not participate in the RFI process.

Sigma Computing’s Product Experience was impacted by its 48.3% performance in Reliability, where it lacks NLP functionality. Customer Experience was impacted by its 32.2% performance in TCO/ROI, where it could provide more information the help an organization quantify costs and benefits.

Sigma Computing performed best in Product Experience, notably in Capability, where its 14th-place ranking was due to its support for sharing analyses individually, via subscriptions or in discussion groups including via external collaboration tools. It provides version control of shared analyses via tagging. In addition, Sigma Computing’s provides a unique capability for simultaneous live editing of analyses.

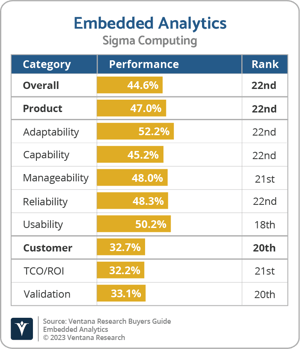

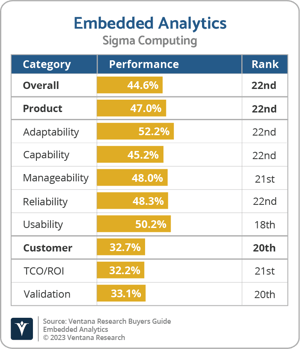

In the Embedded Analytics Buyers Guide, our analysis classified Sigma Computing as a vendor of Merit, ranking 22nd in the overall research at 44.6%. Sigma Computing’s best performance came in Customer Experience at 32.7%, ranking 20th, due in part to its 20th-place ranking in Validation. In Product Experience, Sigma Computing placed 22nd at 47.0% due to low performance in Reliability, Adaptability and Capability. Sigma Computing did not participate in the RFI process.

performance came in Customer Experience at 32.7%, ranking 20th, due in part to its 20th-place ranking in Validation. In Product Experience, Sigma Computing placed 22nd at 47.0% due to low performance in Reliability, Adaptability and Capability. Sigma Computing did not participate in the RFI process.

Sigma Computing’s Product Experience was impacted by its 45.2% performance in Capability, where it lacks some of the data access functionality of other products. Customer Experience was impacted by its 32.2% performance in TCO/ROI, where it could provide more information the help an organization quantify costs and benefits.

Sigma Computing performed best in Product Experience, notably in Usability, where it 50.2% performance was due to its unique support for spreadsheet-style data entry, which few vendors offer, and rapid training based on its spreadsheet-style interface. In addition, Sigma Computing provides built in forecasting functionality based in part on its data entry capabilities.

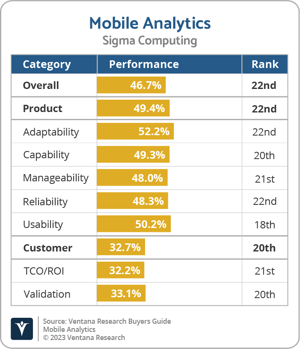

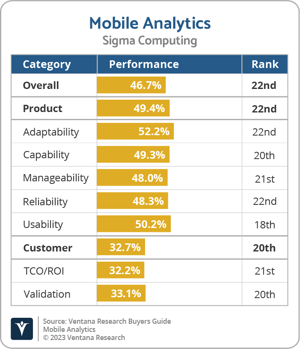

In the Mobile Analytics Buyers Guide, our analysis classified Sigma Computing as a vendor of Merit, ranking 22nd in the overall research at 46.7%. Sigma Computing’s best performance came in Customer Experience at 32.7%, ranking 20th, due in part to its 20th-place ranking in Validation. In Product Experience, Sigma Computing placed 22nd at 49.4% due to low performance in Reliability and Adaptability. Sigma Computing did not participate in the RFI process.

came in Customer Experience at 32.7%, ranking 20th, due in part to its 20th-place ranking in Validation. In Product Experience, Sigma Computing placed 22nd at 49.4% due to low performance in Reliability and Adaptability. Sigma Computing did not participate in the RFI process.

Sigma Computing’s Product Experience was impacted by its 48.3% performance in Reliability, where it could provide more support for performance optimization and business continuity. Customer Experience was impacted by its 32.2% performance in TCO/ROI, where it could provide more information the help an organization quantify costs and benefits.

Sigma Computing performed best in Product Experience, notably in Usability, where its 50.2% performance was due to its support for data entry, which few vendors offer, and rapid training based on its spreadsheet-style interface. In Capability, Sigma Computing offers two design modes: synchronized mobile layout and customized mobile layout, enabling highly customized mobile designs or design once, deploy anywhere functionality.

This assessment was based on Sigma, Version July 2023, and was available in July of 2023.

This research-based index is the most comprehensive assessment of the value of analytics and data software in the industry. Technology buyers can learn more about how to use our Buyers Guide by clicking here and included vendors that wish to learn more can click here. Click below to read the individual reports:

Analytics and Data Buyers Guide

Augmented Analytics Buyers Guide

Collaborative Analytics Buyers Guide

Embedded Analytics Buyers Guide

Mobile Analytics Buyers Guide

performance came in Customer Experience at 32.7%, ranking 20th, due in part to its 20th-place ranking in Validation. In Product Experience, Sigma Computing placed 22nd at 45.6% due to low performance in Reliability, Adaptability and Capability. Sigma Computing did not participate in the RFI process.

performance came in Customer Experience at 32.7%, ranking 20th, due in part to its 20th-place ranking in Validation. In Product Experience, Sigma Computing placed 22nd at 45.6% due to low performance in Reliability, Adaptability and Capability. Sigma Computing did not participate in the RFI process. performance came in Customer Experience at 32.7%, ranking 20th, due in part to its 20th-place ranking in Validation. In Product Experience, Sigma Computing placed 22nd at 39.9% due to low performance in Reliability, Adaptability and Capability. Sigma Computing did not participate in the RFI process.

performance came in Customer Experience at 32.7%, ranking 20th, due in part to its 20th-place ranking in Validation. In Product Experience, Sigma Computing placed 22nd at 39.9% due to low performance in Reliability, Adaptability and Capability. Sigma Computing did not participate in the RFI process. performance came in Customer Experience at 32.7%, ranking 20th, due in part to its 20th-place ranking in Validation. In Product Experience, Sigma Computing placed 21st at 45.2% due to low performance in Reliability and Adaptability. Sigma Computing did not participate in the RFI process.

performance came in Customer Experience at 32.7%, ranking 20th, due in part to its 20th-place ranking in Validation. In Product Experience, Sigma Computing placed 21st at 45.2% due to low performance in Reliability and Adaptability. Sigma Computing did not participate in the RFI process. performance came in Customer Experience at 32.7%, ranking 20th, due in part to its 20th-place ranking in Validation. In Product Experience, Sigma Computing placed 22nd at 47.0% due to low performance in Reliability, Adaptability and Capability.

performance came in Customer Experience at 32.7%, ranking 20th, due in part to its 20th-place ranking in Validation. In Product Experience, Sigma Computing placed 22nd at 47.0% due to low performance in Reliability, Adaptability and Capability.  came in Customer Experience at 32.7%, ranking 20th, due in part to its 20th-place ranking in Validation. In Product Experience, Sigma Computing placed 22nd at 49.4% due to low performance in Reliability and Adaptability. Sigma Computing did not participate in the RFI process.

came in Customer Experience at 32.7%, ranking 20th, due in part to its 20th-place ranking in Validation. In Product Experience, Sigma Computing placed 22nd at 49.4% due to low performance in Reliability and Adaptability. Sigma Computing did not participate in the RFI process.