We are happy to share some insights about NICE drawn from our latest market research, Ventana Research Buyers Guide: Contact Center Suites, which assesses how well vendors’ offerings meet buyers’ requirements.

We recently published three Ventana Research 2023 Contact Center Suites Buyers Guides, an assessment of technology vendors and products that provide individual and combined  contact center and agent management platform support. We developed three technology assessment and buyers guides to focus on overall Contact Center Suites requirements as well as specific Agent Management and Contact Center use-cases.

contact center and agent management platform support. We developed three technology assessment and buyers guides to focus on overall Contact Center Suites requirements as well as specific Agent Management and Contact Center use-cases.

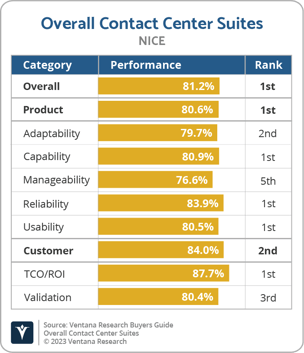

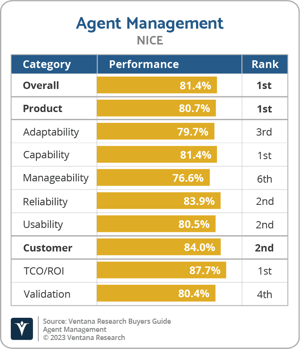

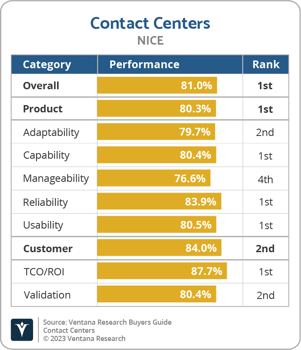

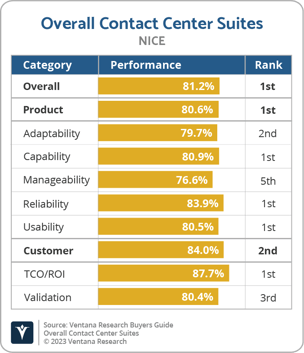

In all of our Buyers Guides we utilize a structured research methodology called the Value Index that includes evaluation categories designed to reflect real-world criteria incorporated in a request for proposal (RFP) and vendor selection process for contact center suites. We evaluated NICE and 21 other vendors in seven categories, five relevant to the product (adaptability, capability, manageability, reliability and usability) and two related to the vendor (TCO/ROI and vendor validation). To arrive at the Value Index rating for a given vendor, we weighted each category to reflect its relative importance in an RFP process, with the weightings based on our experience and on data derived from our benchmark research on contact center suites and agent management.

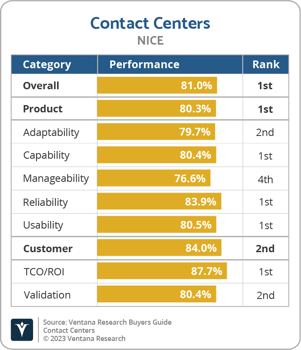

In the overall Contact Center Suites Buyers Guide, our analysis classified NICE as Exemplary, ranking first in the overall research with an 81.0% performance. NICE’s best performance came in Product Experience at 80.3%, ranking first, due in part to its first-place ranking in Reliability. In Customer Experience, NICE placed second at 84.0%. NICE was designated a Leader in Adaptability, Capability, Reliability, Usability, TCO/ROI and Validation. NICE fully participated in the RFI process.

ranking first, due in part to its first-place ranking in Reliability. In Customer Experience, NICE placed second at 84.0%. NICE was designated a Leader in Adaptability, Capability, Reliability, Usability, TCO/ROI and Validation. NICE fully participated in the RFI process.

NICE’s Product Experience was impacted by its 76.6% performance in Manageability, where it could look to improve the documentation around its privacy and security information.

Customer Experience was slightly impacted by its 80.4% performance in Validation, where it could continue to expand its customer stories within the industries it serves.

NICE performed best in Product Experience, notably in Capability, where its 80.4% performance was due to its industry-leading contact center platform. In addition, NICE’s strong stories of strategic value led to its 87.7% performance in TCO/ROI. NICE received high Product Experience scores across categories, including routing, analytics and workforce management forecasting. In addition, the company fared well in basic areas like reliability, ease of administration and deployment, scalability and ongoing investment in improvement across the board.

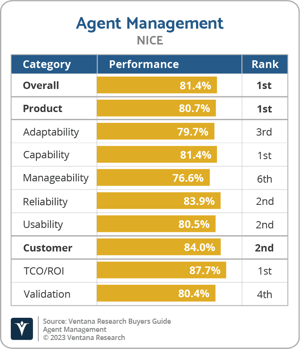

In the Agent Management Buyers Guide, our analysis classified NICE as Exemplary, ranking first in the overall research with an 81.4% performance. NICE’s best performance came in Product Experience at 80.7%, ranking first, due in part to its first-place ranking in Capability. In Customer Experience, NICE placed second at 84.0%. NICE was designated a Leader in Adaptability, Capability, Reliability, Usability and TCO/ROI.

due in part to its first-place ranking in Capability. In Customer Experience, NICE placed second at 84.0%. NICE was designated a Leader in Adaptability, Capability, Reliability, Usability and TCO/ROI.

NICE’s Product Experience was impacted by its 76.6% performance in Manageability, where its documentation on privacy and security was slightly lacking compared to the overall market. Customer Experience was impacted by its 80.4% performance in Validation, where it could continue to flesh out its product roadmap to showcase its investment in future improvements.

NICE performed best in Product Experience, notably in Capability, where its 81.4% performance was due to its near top-of-the-line agent management capabilities. In addition, NICE’s commitment to the overall customer experience led to its first-place performance in TCO/ROI.

In the Contact Centers Buyers Guide, our analysis classified NICE as Exemplary, ranking first in the overall research with an 81.0% performance. NICE’s best performance came in Product Experience at 80.3%, ranking first, due in  part to its first-place ranking in Reliability. In Customer Experience, NICE placed second at 84.0%. NICE was designated a Leader in Adaptability, Capability, Reliability, Usability, TCO/ROI and Validation.

part to its first-place ranking in Reliability. In Customer Experience, NICE placed second at 84.0%. NICE was designated a Leader in Adaptability, Capability, Reliability, Usability, TCO/ROI and Validation.

NICE’s Product Experience was impacted by its 76.6% performance in Manageability, where it could look to improve the documentation around its privacy and security information.

Customer Experience was slightly impacted by its 80.4% performance in Validation, where it could continue to expand its customer stories within the industries it serves.

NICE performed best in Product Experience, notably in Capability, where its 80.4% performance was due to its industry-leading contact center platform. In addition, NICE’s strong stories of strategic value led to its 87.7% performance in TCO/ROI. NICE received high Product Experience scores across categories, including routing, analytics and workforce management forecasting. In addition, the company fared well in basic areas like reliability, ease of administration and deployment, scalability and ongoing investment in improvement across the board.

This assessment was based on NICE CXOne, v. Summer ’23 and was available in June of 2023.

This research-based index is the most comprehensive assessment of the value of contact center suites software in the industry. Technology buyers can learn more about how to use our Buyers Guide by clicking here and included vendors that wish to learn more can click here. Click below to read the individual reports:

ranking first, due in part to its first-place ranking in Reliability. In Customer Experience, NICE placed second at 84.0%. NICE was designated a Leader in Adaptability, Capability, Reliability, Usability, TCO/ROI and Validation. NICE fully participated in the RFI process.

ranking first, due in part to its first-place ranking in Reliability. In Customer Experience, NICE placed second at 84.0%. NICE was designated a Leader in Adaptability, Capability, Reliability, Usability, TCO/ROI and Validation. NICE fully participated in the RFI process. due in part to its first-place ranking in Capability. In Customer Experience, NICE placed second at 84.0%. NICE was designated a Leader in Adaptability, Capability, Reliability, Usability and TCO/ROI.

due in part to its first-place ranking in Capability. In Customer Experience, NICE placed second at 84.0%. NICE was designated a Leader in Adaptability, Capability, Reliability, Usability and TCO/ROI. part to its first-place ranking in Reliability. In Customer Experience, NICE placed second at 84.0%. NICE was designated a Leader in Adaptability, Capability, Reliability, Usability, TCO/ROI and Validation.

part to its first-place ranking in Reliability. In Customer Experience, NICE placed second at 84.0%. NICE was designated a Leader in Adaptability, Capability, Reliability, Usability, TCO/ROI and Validation.