We are happy to share some insights about AWS drawn from our latest market research, Ventana Research Buyers Guide: Contact Center Suites, which assesses how well vendors’ offerings meet buyers’ requirements.

We recently published three Ventana Research 2023 Contact Center Suites Buyers Guides, an assessment of technology vendors and products that provide individual and combined  contact center and agent management platform support. We developed three technology assessment and buyers guides to focus on overall Contact Center Suites requirements as well as specific Agent Management and Contact Center use-cases.

contact center and agent management platform support. We developed three technology assessment and buyers guides to focus on overall Contact Center Suites requirements as well as specific Agent Management and Contact Center use-cases.

In all of our Buyers Guides we utilize a structured research methodology called the Value Index that includes evaluation categories designed to reflect real-world criteria incorporated in a request for proposal (RFP) and vendor selection process for contact center suites. We evaluated AWS and 21 other vendors in seven categories, five relevant to the product (adaptability, capability, manageability, reliability and usability) and two related to the vendor (TCO/ROI and vendor validation). To arrive at the Value Index rating for a given vendor, we weighted each category to reflect its relative importance in an RFP process, with the weightings based on our experience and on data derived from our benchmark research on contact center suites and agent management.

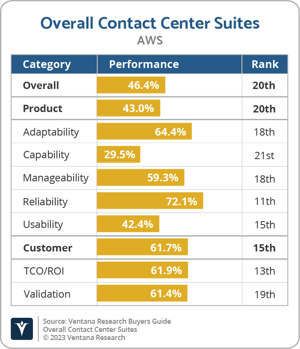

In the overall Contact Center Suites Buyers Guide, our analysis classified AWS as a vendor of Merit, ranking 20th in the overall research with a 46.4% performance. AWS’s best performance came in Customer Experience at 61.7%, ranking 15th, due in part to its 13th-place ranking in TCO/ROI. In Product Experience, AWS placed 20th at 43.0% due to low performance in Capability. AWS partially participated in the RFI process.

at 61.7%, ranking 15th, due in part to its 13th-place ranking in TCO/ROI. In Product Experience, AWS placed 20th at 43.0% due to low performance in Capability. AWS partially participated in the RFI process.

AWS’s Product Experience was impacted by its 29.5% performance in Capability, where it lacks features in quality management and knowledge management. It also contains rudimentary interaction analytics. Customer Experience was impacted by its 61.4% performance in Validation, where it could devote more resources to buyer TCO calculations.

AWS performed best in Customer Experience, notably in TCO/ROI, where its 61.9% performance was due to its almost unlimited resources and control of the underlying AWS cloud infrastructure. In addition, AWS ranked 11th in Reliability at 72.1% due to its strong infrastructure that is widely used across the marketspace.

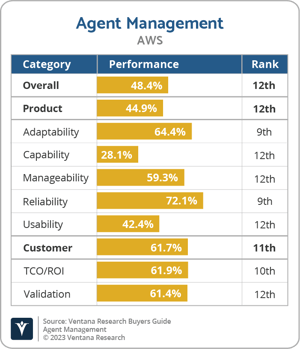

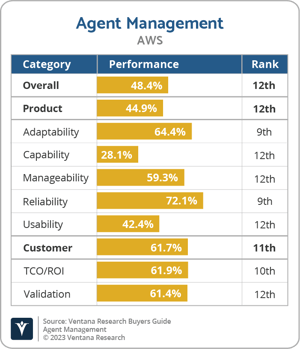

In the Agent Management Buyers Guide, our analysis classified AWS as a vendor of Merit, ranking 12th in the overall research with a 48.4% performance. AWS’ best performance came in Customer Experience at 61.7%, ranking 11th, due in part to its 10th-place ranking in TCO/ROI. In Product Experience, AWS placed 12th at 44.9% due to low performance in Capability. AWS partially participated in the RFI process.

11th, due in part to its 10th-place ranking in TCO/ROI. In Product Experience, AWS placed 12th at 44.9% due to low performance in Capability. AWS partially participated in the RFI process.

AWS’ Product Experience was impacted by its 28.1% performance in Capability, due in part to its lack of agent management capabilities compared to the rest of the industry. Customer Experience was impacted by its 61.9% performance in TCO/ROI, due to the lack of documentation positioning the value derived from AWS.

AWS performed best in Product Experience, notably in Reliability, where its 72.1% performance was due to its vast technology architecture and the reliability of the AWS platform. In addition, AWS’ scalability led to its performance in Reliability.

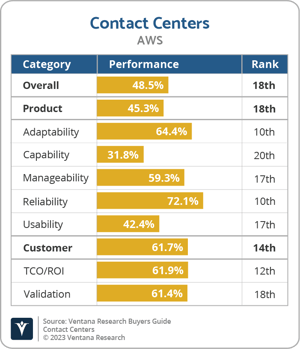

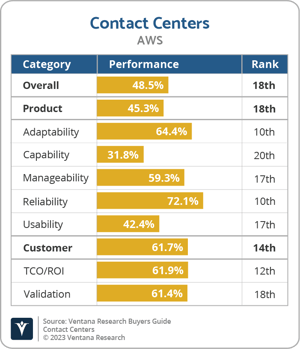

In the Contact Centers Buyers Guide, our analysis classified AWS as a vendor of Merit, ranking 18th in the overall research with a 48.5% performance. AWS’s best performance came in Customer Experience at 61.7%,  ranking 14th, due in part to its 12th-place ranking in TCO/ROI. In Product Experience, AWS placed 18th at 45.6% due to low performance in Capability. AWS partially participated in the RFI process.

ranking 14th, due in part to its 12th-place ranking in TCO/ROI. In Product Experience, AWS placed 18th at 45.6% due to low performance in Capability. AWS partially participated in the RFI process.

AWS’s Product Experience was impacted by its 31.8% performance in Capability, where it needs to flesh out its contact center platform with more capabilities that are considered table stakes in the rest of the industry.

Customer Experience was impacted by its 61.4% performance in Validation, where it could document more of the kickoff and onboarding process for potential customers.

AWS performed best in Customer Experience, notably in TCO/ROI, where its 61.9% performance was due to the large number of customer stories and business cases showing the returns from using AWS. In addition, AWS’s considerable resources and investments in their technology stack led to its 72.1% performance in Reliability.

This assessment was based on Amazon Connect and was available in July of 2023.

This research-based index is the most comprehensive assessment of the value of contact center suites software in the industry. Technology buyers can learn more about how to use our Buyers Guide by clicking here and included vendors that wish to learn more can click here. Click below to read the individual reports:

Contact Center Suites Buyers Guide

Agent Management Buyers Guide

Contact Centers Buyers Guide

at 61.7%, ranking 15th, due in part to its 13th-place ranking in TCO/ROI. In Product Experience, AWS placed 20th at 43.0% due to low performance in Capability. AWS partially participated in the RFI process.

at 61.7%, ranking 15th, due in part to its 13th-place ranking in TCO/ROI. In Product Experience, AWS placed 20th at 43.0% due to low performance in Capability. AWS partially participated in the RFI process. 11th, due in part to its 10th-place ranking in TCO/ROI. In Product Experience, AWS placed 12th at 44.9% due to low performance in Capability. AWS partially participated in the RFI process.

11th, due in part to its 10th-place ranking in TCO/ROI. In Product Experience, AWS placed 12th at 44.9% due to low performance in Capability. AWS partially participated in the RFI process. ranking 14th, due in part to its 12th-place ranking in TCO/ROI. In Product Experience, AWS placed 18th at 45.6% due to low performance in Capability. AWS partially participated in the RFI process.

ranking 14th, due in part to its 12th-place ranking in TCO/ROI. In Product Experience, AWS placed 18th at 45.6% due to low performance in Capability. AWS partially participated in the RFI process.